Content

SBICs invest in small businesses

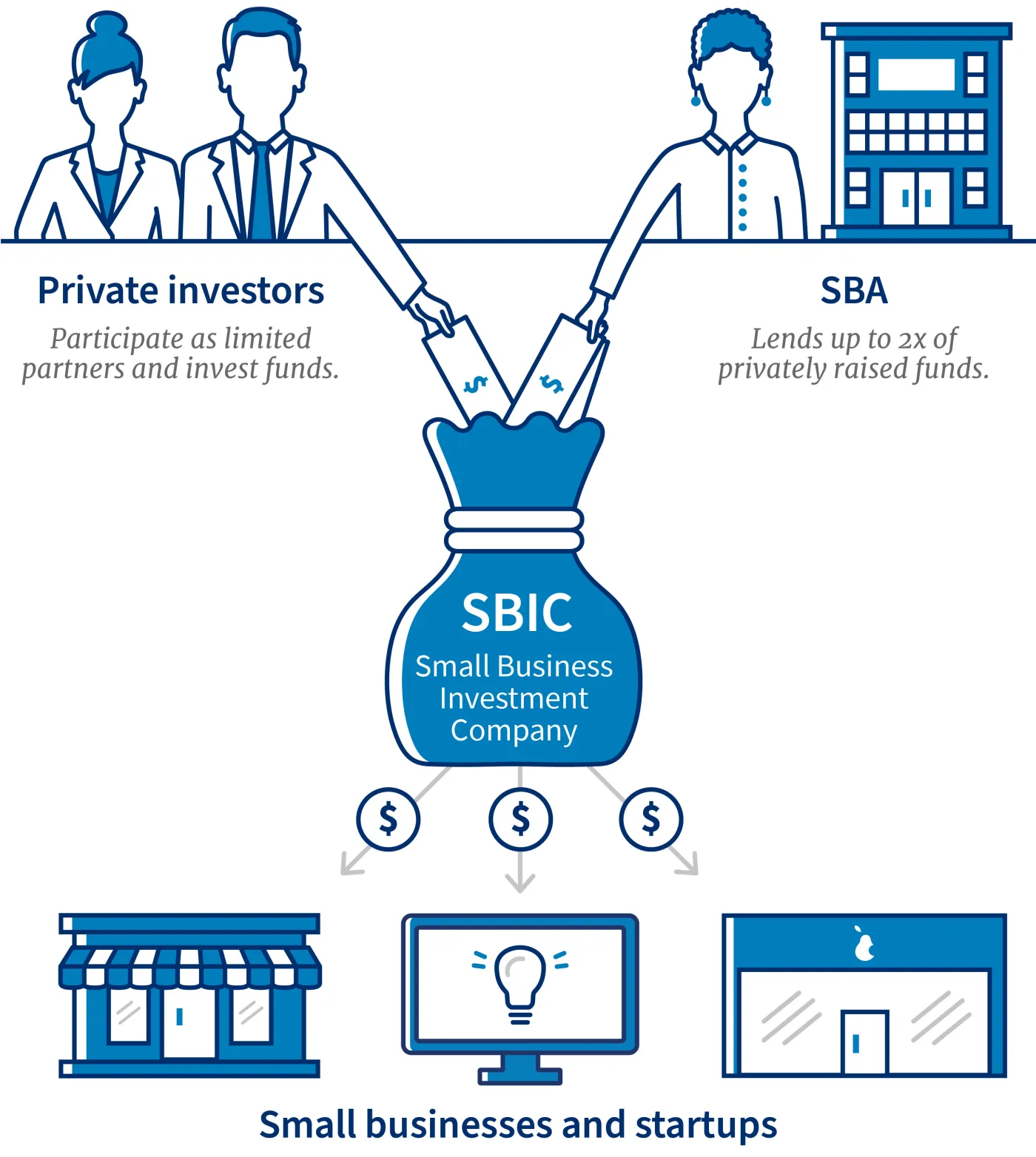

An SBIC is a privately owned company that’s licensed and regulated by the SBA. SBICs invest in small businesses in the form of debt and equity. The SBA doesn’t invest directly into small businesses, but it does provide funding to qualified SBICs with expertise in certain sectors or industries. Those SBICs then use their private funds, along with SBA-guaranteed funding, to invest in small businesses.

What you can get

SBICs invest in small businesses through debt, equity, or a combination of both. Debt is a loan an SBIC gives to a business, which the business must pay back, along with any interest. Equity is a share of ownership an SBIC gets in a business in exchange for providing funding. Sometimes, an SBIC invests in a business through both debt and equity. Such an investment includes both loans and shares of ownership. A typical SBIC investment is made over a 3-year period.

-

Debt

A typical SBIC loan ranges from $250,000 to $10 million, with an interest rate between 9% and 16%. -

Equity

SBICs will invest in your business in exchange for a share of ownership in your company. Typical investments range from $100,000 to $5 million. -

Debt with equity

Financing includes loans and ownership shares. Loan interest rates are typically between 10% and 14%. Investments range from $250,000 to $10 million.

Check your eligibility

SBICs typically target mature, profitable businesses with sufficient cashflow to pay interest. However, each SBIC has its own investment profile in terms of targeted industry, geography, company maturity, and the types and size of financing they provide. There are a few universal requirements.

-

Be a U.S. business

At least 51% of your employees and assets must be within the U.S.

At least 51% of your employees and assets must be within the U.S. -

Be a small business

Qualify as a small business according to SBA size standards.

Qualify as a small business according to SBA size standards. -

Be in an approved industry

Farmland, real estate, and financing are some of the industries that don’t qualify.

Farmland, real estate, and financing are some of the industries that don’t qualify.

Find an investor

If your small business is interested in SBIC financing, take the following steps when you approach an SBIC.

-

1. Research an SBIC

Find an SBIC using our online directory, and make sure they’re actively investing in businesses in your region, size, and industry.

Find an SBIC using our online directory, and make sure they’re actively investing in businesses in your region, size, and industry. -

2. Prepare your business plan

Get ready to make the case that investing in your business would be profitable for the SBIC.

Get ready to make the case that investing in your business would be profitable for the SBIC. -

3. Contact an SBIC

For the best chance to get financing, use your network. Talk to accountants, attorneys, and executives to get an introduction to an SBIC.

For the best chance to get financing, use your network. Talk to accountants, attorneys, and executives to get an introduction to an SBIC.